Reason #4 to Vote Blue on Nov 5

Trump’s plan is to LOWER the corporate tax rate from 21% to 20%.*

Biden’s plan is to RAISE the corporate tax rate from 21% to 28%.*

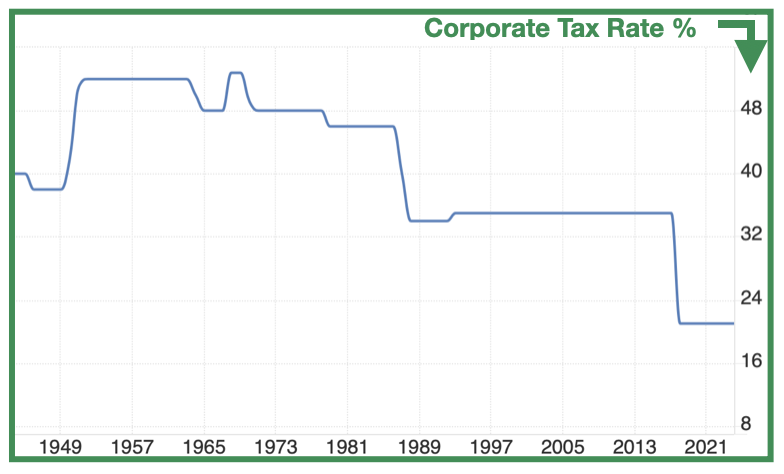

This is the history of the corporate tax rate from World War II:**

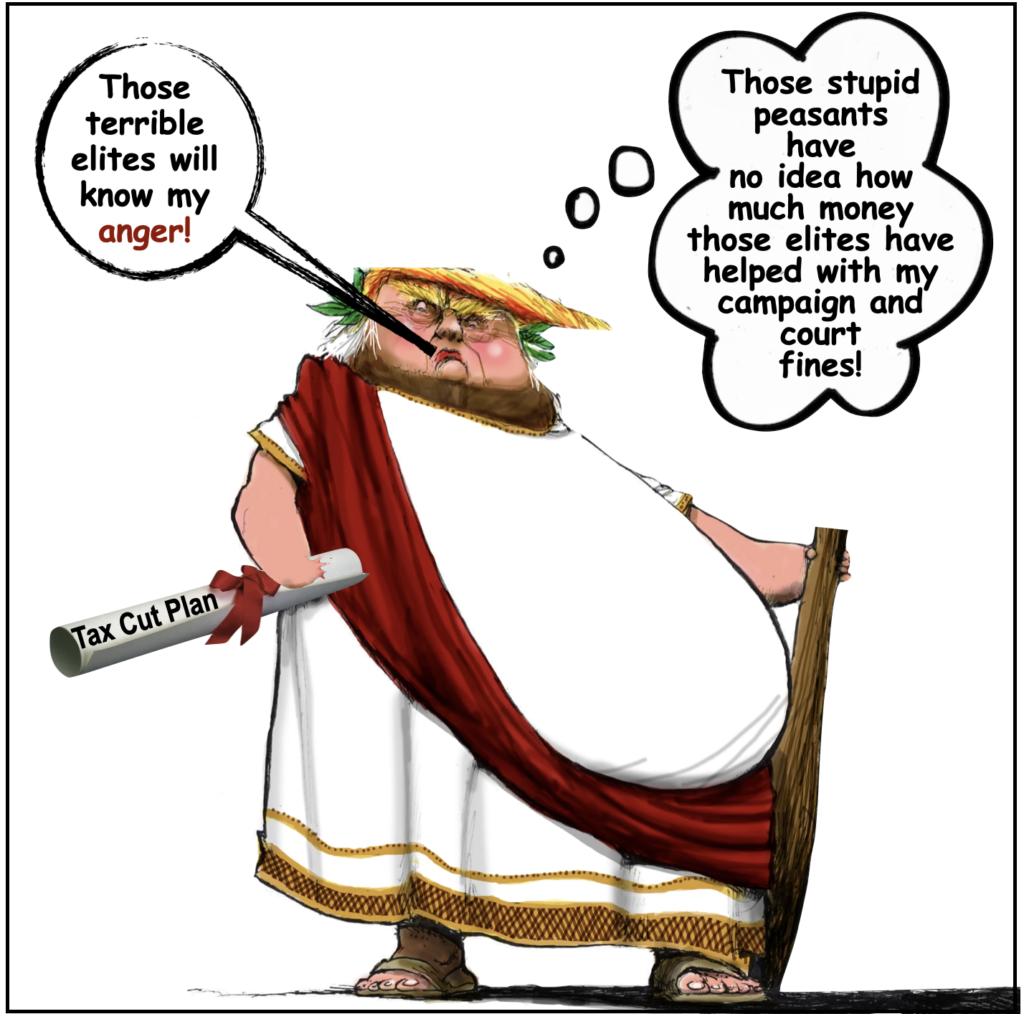

Trump and the GOP lowered the corporate tax rate in 2017 from 35% to 21% as part of the infamous 2017 Tax Cut and Jobs Act. At the time, GOP leaders said this would lead to more business investment and higher wages for families. Neither of those things happened. Instead, the tax savings corporations received, especially the largest corporations, went into stock buy-backs to increase the stock gain and into insanely higher “salaries” for corporate executives. In short, the corporate tax cut was a gift to the “elite” even though Trump continues to claim he opposes the elite.

Meanwhile, because “trickle-down” economics is a myth foisted on us by “the elite,” the tax cut led to record national debt.

My childhood in the 1950s and 1960s took place during great prosperity, even though the corporate tax rate was between 46% and 52%! Raising the corporate tax rate will HELP the economy for all of us – if that cash is used by the government for infrastructure, education, training, and research!***

Resources:

- * Candidates: https://taxfoundation.org/research/federal-tax/2024-tax-plans/#Type

- ** The rate chart: https://tradingeconomics.com/united-states/corporate-tax-rate

- *** WHY the corporate tax is essential, a Robert Reich illustrated video: https://www.youtube.com/watch?v=LyCjx2yCgi8

- A full explanation of the failure of the 2017 tax cut: https://www.americanprogress.org/article/the-tax-cuts-and-jobs-act-failed-to-deliver-promised-benefits/