Reason #26 to Vote Blue on Nov 5

In “Reason #25,” I argued that Trump is deceiving many in the middle class who think he is on their side. He is not a populist.

One way you can genuinely tell a populist is by their tax policies. If a candidate favors generating government revenues using regressive taxes that favor the rich over the middle class and the poor then they are elites, not populists. A sales tax and tariffs are examples of regressive taxes (note 1). Because they raise the prices of things that everyone buys; they hurt those with lower incomes. On the other hand a progressive income tax (note 2) is a “fair” tax. A straight income tax has one rate for everyone. A progressive income tax (sometimes called a graduated income tax) has multiple tax rates assigned to different income levels, with higher tax rates for higher income people.

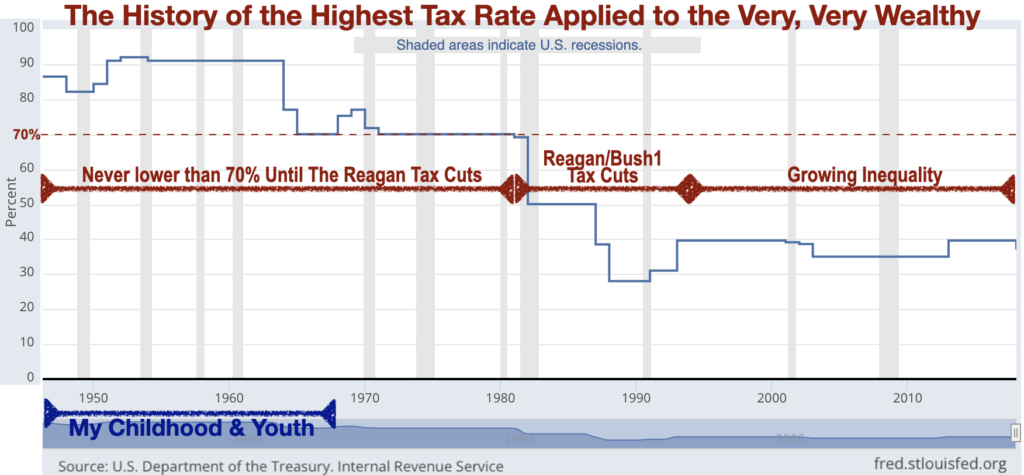

Until I was 36 years old, the tax rate for the very, very wealthy was never lower than 70% (but sometimes 90%) (note 3)! Still, it was one of the best periods ever for business, for jobs, and for the middle class, and I am lucky to have lived through that period.

Unfortunately, then came Reagan and the GOP preaching the gospel of tax cuts for the rich and trickle-down benefits for the middle class and the poor. Turns out, that is a false gospel; “trickle-down” is more trick than treat.

Trickle-down benefits to the middle class and poor depend upon corporate owners and leaders doing what’s best for the country: re-investing in research to find new products leading to new jobs, giving workers better wages, and hiring more workers. But corporate owners and CEOs are profit-driven. That’s why, instead, the big tax savings are used to build profits through stock-buybacks and giant CEO salary increases (note 4).

What did Trump’s much touted 2017 tax cut do? It (1) reduced the top individual tax rate, for the highest earners, from 39.6% to 37%; (2) dropped the corporate tax rate dropped from 35% to 21% [see Reason #4], and (3) created a new deduction to reduce taxes by up to 20% for pass-through businesses, such as partnerships and sole proprietorships.

Results? Those in the 95-99% income group ($400K+) got a 3.2% cut. Those below the 95% percentile (average income $40K), got cuts between .4% to 1.4% (note 6).

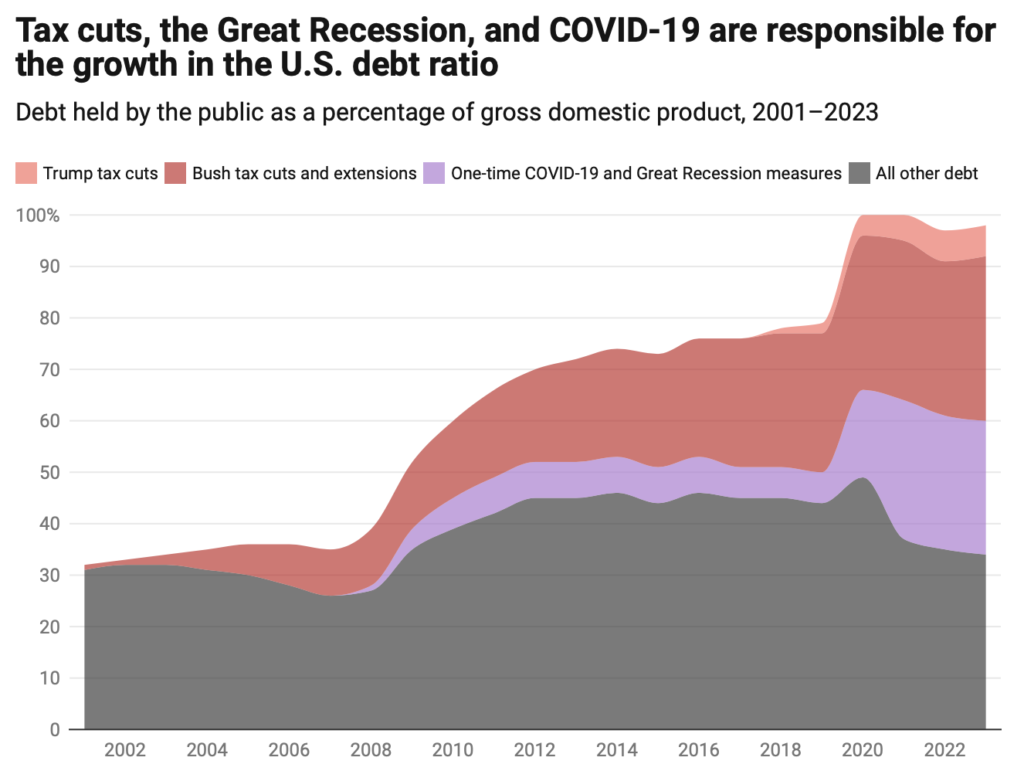

And, since it did not stimulate the economy as they claimed it would, our US Treasury did not take in more tax revenue. Instead our national debt soared once again. According to the Tax Policy Center at the Brookings Institute: “The Tax Cuts and Jobs Act cut taxes substantially from 2018 through 2025. The resulting deficits are adding $1 to $2 trillion to the federal debt, according to official estimates from before and shortly after enactment. The debt increase will be larger if some of TCJA’s temporary tax cuts are extended.”

Were it not for the combined tax cuts made and continued from the Bush2 Era and the 2017 Trump cuts, our total national debt (including from the Great Recession measures and the pandemic measures) would be declining. See chart below.

Trump is calling for another tax cut for the rich if he is elected. What we need to do is raise the tax rates for the wealthy. Republicans keep bringing up the mythological points to stop a tax increase on the wealthy. See video below.

Trump is fooling the many middle class folks who think he is on their side. His tax policies (above) and tarrif policies [see Reason#1] favor the wealthy elites and do little to nothing for the middle class.

Resources:

- (1) Regressive taxes (Wikipedia): https://en.wikipedia.org/wiki/Regressive_tax

- (2) Progressive income tax (Wikipedia): https://en.wikipedia.org/wiki/Progressive_tax

- (3) Income tax rates for the very, very wealthy (Federal Reserve Bank of St Louis) https://fred.stlouisfed.org/series/IITTRHB

- (4) Tax Cuts Are Primarily Responsible for the Increasing Debt Ratio: Without the Bush and Trump tax cuts, debt as a percentage of the economy would be declining permanently: https://www.americanprogress.org/article/tax-cuts-are-primarily-responsible-for-the-increasing-debt-ratio/

- (5) President Trump Tax Cuts Barely Trickling Down To Workers, Here’s Why (MSNBC, June 27, 2018): https://youtu.be/cT4aBhUIvVY?feature=shared

- (6) The 2017 Trump Tax Law Was Skewed to the Rich, Expensive, and Failed to Deliver on Its Promises (Center on Budget and Policy Priorities, June 13, 2024) https://www.cbpp.org/research/federal-tax/the-2017-trump-tax-law-was-skewed-to-the-rich-expensive-and-failed-to-deliver

- (7) 12 Biggest Myths About Raising Taxes on the Rich (Robert Reich, April 15, 2019)