My View: The Very Wealthy Should Pay Their Fair Share

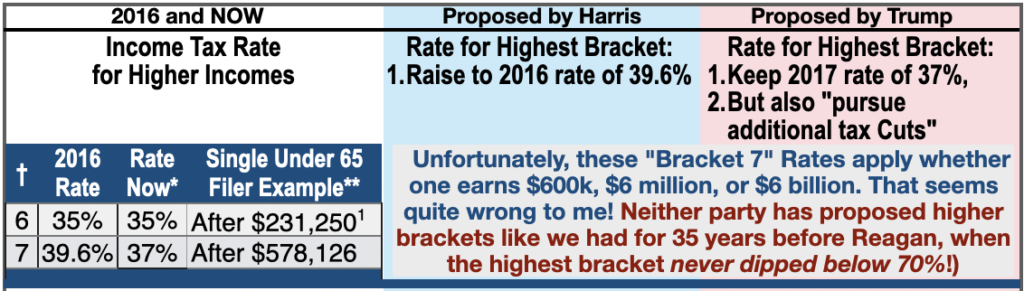

Let’s compare Tax law from 2016 (before the Trump administration), Tax law NOW, and the views of each candidate. Let’s see which candidate swings toward helping the wealthy pay their fair share.

To keep this as simple as possible, I have chosen to show only the facts for a “single taxpayer under 65.” As you know, many of us file as “Married Joint Filers,” or “Head of Household Filers,” “Over 65” and so on. But the rates for all filers go up and down roughly in parallel to our one example – “Single Filer.”

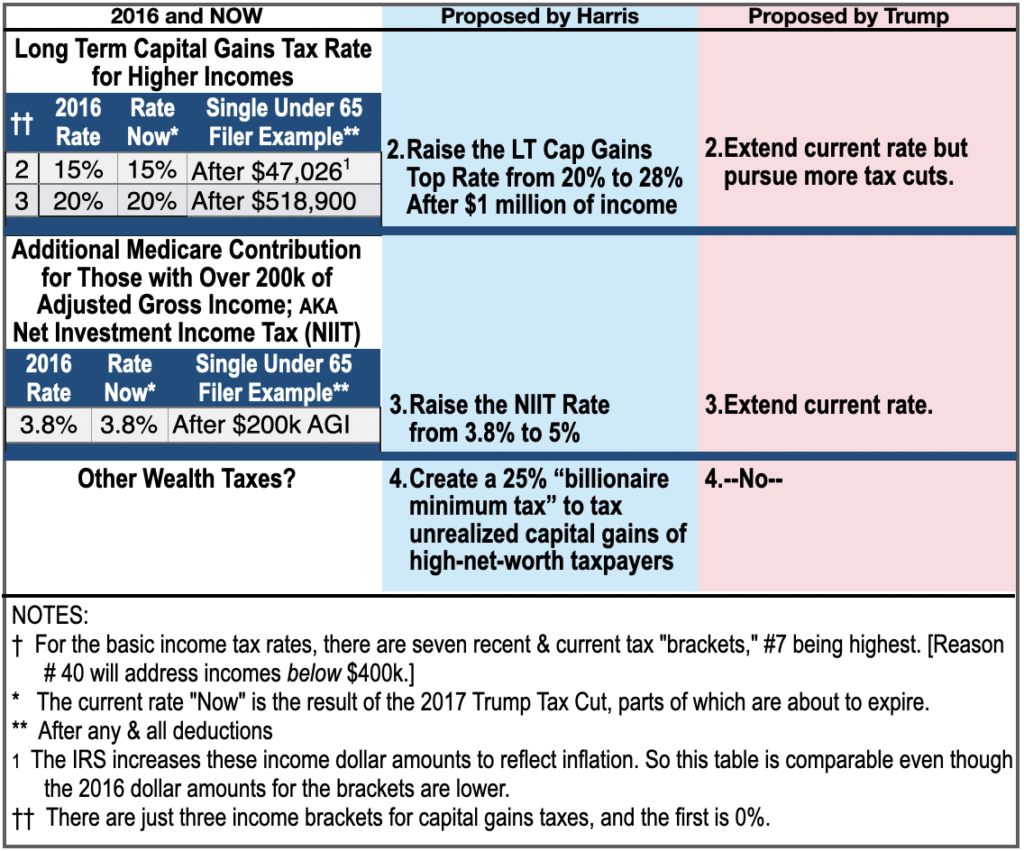

Now let’s look at 3 other changes Harris is suggesting that would affect the high income tax payer:

On the Harris side, the slight increases for the wealthy on items 1, 2, 3 are in the right direction. Wealthy people make most of their money through investments, not wages, so raising the capital gains tax is essential; it is ridiculous to have a 20% top rate (currently) apply to millions of investment earnings while workers are paying a higher rate on wages. Only Item 4 begins to address the very wealthy. It is a small and a controversial way to address wealth inequality. Be sure to watch Trevor Noah’s comments at the bottom of this page regarding “unrealized capital gains.” He makes a suggestion that perhaps instead of a tax, a law might be made forbidding the use of unsold stock shares as collateral for business investment loans. In the meantime, Harris is clearly making proposals in the right direction. Of course a favorable Congress is essential!

On the Trump side, everything is in the wrong direction. The 2017 tax cuts for the rich will be extended and very likely, if the GOP has the votes in Congress they had in 2017, there will be more tax cuts for the rich. And the economy will be thus rigged against the middle class even further.

Just to Be Clear: The Rich Are NOT Paying Their Fair Share Now

Beware of organizations (like the Tax Foundation) that publish charts “proving” that our tax system is already progressive, because the top 1% of taxpayers are a huge percent of all income taxes paid. What that overlooks is the huge amounts of money that the very rich actually make and how little they pay in taxes proportionate to what they make.

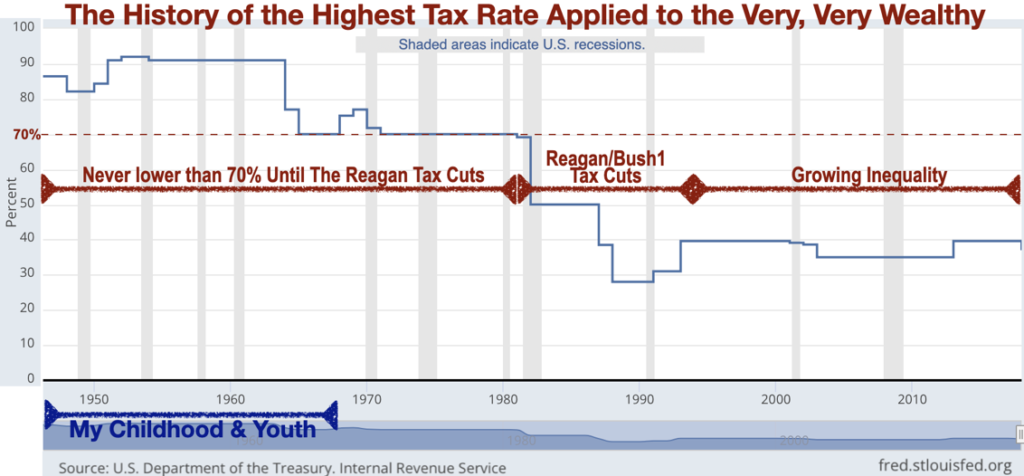

The graph near the top of this post already showed how different the tax rates for the very rich were for the 35 years of my life before Reagan; the rate for the top bracket ranged between 70% – 92%!! Now it’s only 37% – before loopholes that lower the “effective” rate.

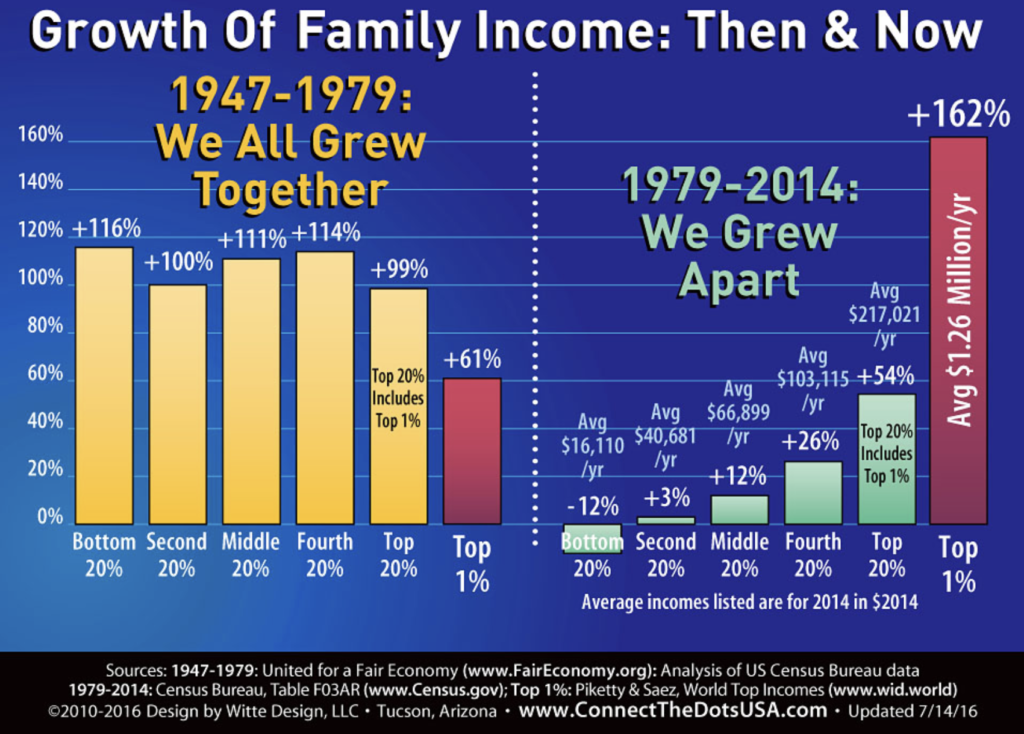

Since the rich stopped paying their fare share starting in the Reagan years , inequality has grown. See the following chart to see how much has changed.

Unfortunately, the excellent chart above only goes to 2014. The last 10 years plus the pandemic enabled the wealthy to quadruple their wealth while millions suffered. See below:

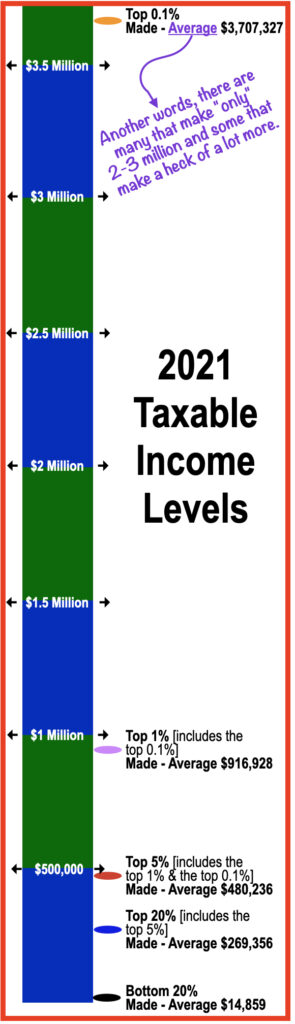

Just 7 brackets for such a spread of incomes. Again, the top bracket now starts at $ 578,126.

There used to be more brackets; for example, in 1978 there were 26 tax brackets. I’d love to see more brackets with higher rates for higher brackets. More tax brackets are essential to distinguish between the middle class tax rate, the millionaire tax rate, and the multi-billionaire tax rate.

Look at the chart on the left. We basically now have 6 tax brackets that cover the bottom $578 thousand and one bracket for all the rest going way past the $3 million point. That is not a progressive tax system.

Again – don’t be fooled by those that say, “The rich already pay their fair share.”

It is critical to remember that Presidents do not make tax law. They can only recommend. Congress makes tax law. That’s why….

Resources:

- 2016 personal income tax rates (Bradford Tax Institute): https://bradfordtaxinstitute.com/Free_Resources/2016-Federal-Tax-Brackets.aspx

- Current personal income tax rates (H&RBlock): https://www.hrblock.com/tax-center/irs/tax-brackets-and-rates/what-are-the-tax-brackets/

- Capital Gains and NIIT (Wikipedia): https://en.wikipedia.org/wiki/Capital_gains_tax_in_the_United_States

- The Net Investment Income Tax (NIIT) – Part of the Affordable Care Act provisions (Wikipedia): https://en.wikipedia.org/wiki/Affordable_Care_Act_tax_provisions#Net_investment_income_tax

- Candidate Plans: Harris

- Harris Campaign Site: https://kamalaharris.com/issues/

- Tax Foundation: https://taxfoundation.org/research/all/federal/kamala-harris-tax-plan-2024/ *

- Candidate Plans: Trump

- Republican Platform on Donald Trump’s Campaign Site: https://rncplatform.donaldjtrump.com/? (page 9)

- Tax Foundation: https://taxfoundation.org/research/all/federal/donald-trump-tax-plan-2024/

- Trump’s Economic Plans (Robert Reich, 9/12/24): https://robertreich.substack.com/p/the-frightening-truth-about-trumps

- Truth and Trickery About the Share of Taxes We Pay

- Irrelevant chart by the Tax Foundation: https://taxfoundation.org/testimony/rich-pay-their-fair-share-of-taxes/

- History of Income Tax and Number of Brackets (Wikipedia): https://en.wikipedia.org/wiki/Income_tax_in_the_United_States#History

- Growth of Income – Measuring Inequality (Lumen Learning): https://courses.lumenlearning.com/wm-microeconomics/chapter/measuring-income-inequality/

- 2021 Inequality Graph: https://prosperousamerica.org/u-s-income-inequality-widened-further-in-2021/ Table with higher brackets (Bankrate): https://www.bankrate.com/investing/income-wealth-top-1-percent/

- What kind of country do you want? Start with taxes (NY Times, 5/30/24): https://www.nytimes.com/2024/05/30/opinion/trump-biden-taxes.html?unlocked_article_code=1.LU4.jFI1.wMmQfOd5kIm0&smid=url-share

* The Tax Foundation has meticulously assembled the known facts of the candidate plans. This was helpful! But beware of their predictive analyses; they should be read as speculative opinions that are probably only partly true. And as also stated above, their bias toward continuing inequality is evident.

Regarding Harris proposal #4, a 25% “billionaire minimum tax” to tax unrealized capital gains of high-net-worth taxpayers: Is it unfair to tax “unrealized gains”? Listen below to Trevor Noah as he explains two ways to look at the “fairness.”