My View: The Tax Code is Overly Complicated, Mostly to Provide Benefits to the Wealthy. A True Reform Would Take Years. In the Meantime, Yes – Add Benefits Targeted to Needy Groups.

Harris’s proposals do target help to the middle class and the barely surviving workers. While Trump’s plan mainly helps the wealthy or else are simply reckless bribes.

Review

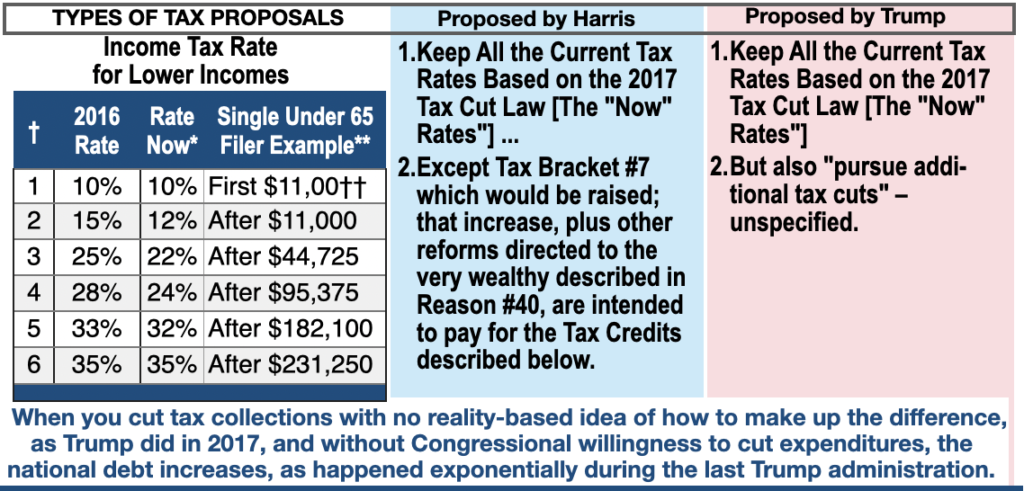

Reason #40 looked at tax change proposals that impact those with incomes above $400K. There we saw how Trump wants to keep the 2017 tax cut for Bracket 7 people while also hoping to get another cut in the rate. (He also has foolishly talked about eliminating the income tax in favor of relying on tariffs! Talk about wrecking the economy!!) Meanwhile, Harris wants to raise the tax rate on the top Bracket (7) from a 37% rate back to the puny pre-Trump level of 39.6%. (Ideally, there should be more brackets with higher rates for the taxpayers for the 5%, 1%, and .1% income levels.) Additionally, Harris has proposed other ways to tax the richest among us to move us back toward a more fair system of taxation that helps to reduce economic inequality:

- Raise the Long Term Capital Gains Top Rate from 20% to 28% After $1 million of income

- Raise the NIIT Rate from 3.8% to 5%. (This is the rate used to determine Medicare contributions.)

- Create a 25% “billionaire minimum tax” to tax unrealized capital gains of high-net-worth taxpayers.

1) Income Tax Rates:

Compare Proposals for Helping the Middle Class and Entry Working Class

Harris has pledged that she would not raise taxes on anyone making less than $400K. So basically that is tax brackets 1-6. Again, I wish she would have argued for more brackets, but at least it is in the right direction, especially when we take into consideration the other 3 proposals for squeezing revenue from the rich (listed in the Review above).

It is important to understand that the 2017 personal tax rate reductions are temporary and expire in 2025. If Congress does not take action, the tax rates for all 7 brackets will revert to the 2016 tax rates (an increase in five of the brackets).

It is most likely (I think) that Congress will act to extend the cuts either permanently or for another period of 7 years. The fight will be over Bracket 7 where Harris rightly wants to increase the rate to 39.6%. – the top bracket (which starts with those having incomes over $519K). This will be opposerd by the GOP bny tooth and nail. Again, remember that the top rate was over 70% for the first 35 years of my life… until Reagan. (See chart at Reason #40.)

Trump, on the other hand, wants to keep all of the 2017 tax cuts including and especially Bracket 7 – for the wealthy. And he has said on a number of occasions that he would “pursue additional tax cuts.” And, just as in 2017, he has no plan for making up the lower tax revenue. Unlike Harris, he certainly has no concerns about needing tax money to assist the borderline surviving workers.

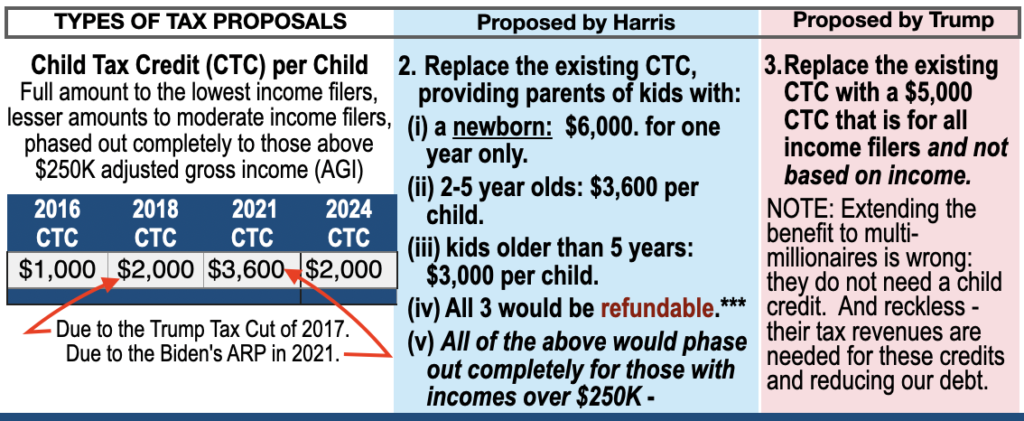

2) Child Tax Credit (CTC):

Compare Proposals for Helping the Middle Class and Entry Working Class

*** Refundable means that those with very low income and negligible or no tax, can receive the entire amount as a refund or in monthly amounts. They need to file a return even though they know they owe no tax, in order to get the cash pay-out. This is good for kids of parents with barely survivable incomes – see references.

The child tax credit was introduced by a change in tax law in 1997. This is a tax credit (not a deduction) which means that the credit is used to reduce your tax based on your “adjusted gross income” (“AGI” – the amount of your income after all exemptions and deductions have been used).

It would appear that both parties favor the help provided by the CTC. BUT – Yet, please note:

(1) A large number of Republicans do not favor the credit, and especially oppose one that does not also give handouts to the wealthy families with children. I have tried to make clear in previous “reasons” that this IS THE PARTY OF THE WEALTHY ELITE. They have opposed Social Security (since FDR), Medicare (since LBJ), and the Affordable Healthcare Act (since Obama). A recent vote in Congress to raise the CTC amount was defeated when opposed by every Republican. Even Trump may not be persuasive. So Remember: because Presidents can propose, but do not make tax law…..

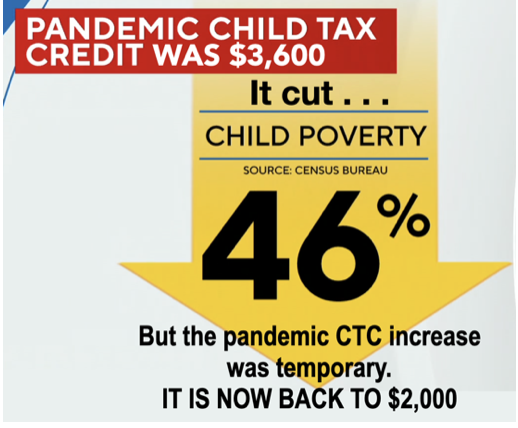

(2) Vance came up with the $5000 CTC for all families. It appears that Trump will support it. But why on earth for all families? Certainly high income families have no problem feeding their families. And the cost to the National Debt is therefore pointless. It is as reckless as the 2017 so-called Tax Reform Act which benefitted the wealthy, but did not stimulate the economy as predicted, and so the National Debt skyrocketed. It did not “pay for itself” because “trickle-down economics” is a myth. The Harris plan is better for everyone because when the middle-class is successful, everyone benefits... even the wealthy.

Harris’s plan for child tax credits targets those who need it. And she has a plan to pay for it (Reason #40). Her plan is the common sense plan to both help children and keep the economy growing.

Learn more from this brief NBC news analysis, 3-minute video overview: https://www.cbsnews.com/video/harris-and-trump-both-push-for-child-tax-credit-hike (It doesn’t let me embed it here.)

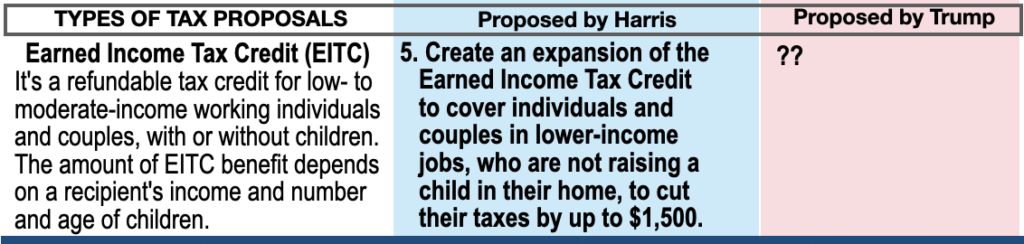

3) Earned Income Tax Credit (EITC):

Compare Proposals for Helping the Middle Class and Entry Working Class

This is another proposal to help the workers barely surviving. In 2021, the American Rescue Plan included an expansion of the EITC to individuals and couples who do not have children, so that they can cut their taxes by up to $1,500. It was however a temporary measure; it has now reverted to roughly a $300-500 credit.

Harris is proposing to permanently restore the EITC to $1500 for individuals and couples who do not have children.

4) First New House Tax Credit and Tax Credits for Builders:

Compare Proposals for Helping the Middle Class and Entry Working Class

Harris has proposed a new tax credit: $25,000 to first time home buyers to help with the down payment. This is to put a dent in the housing crisis, but it is only one piece of the plan.

Critics say that this tax credit will cause further shrinking of affordable housing as the credit is used, buying up scarce supply, and thus driving up home prices even further. Again, the credit is only one piece of the plan for expanding affordable housing. That plan begins with expanding the supply of housing. The Chief Economist of Moody’s Analytics described the plan as “the most aggressive supply-side push since the national investment in housing that followed World War II.” And the National Association of Homebuilders said her plan will “help builders to construct badly needed new homes and apartments.” Included in the plan are:

- Unlocking 1.2 million new affordable rental homes through historic incentives for the private sector. This will make use of the existing Low-Income HousingTax Credit (LIHTC), a tax credit that helps make it financially viable for private and non-profit developers to build affordable rental housing. Harris will unlock the potential of the building industry by expanding this proven tax credit to significantly expand affordable rental supply by more than 1.2 million new affordable homes, which will reduce rental prices.

- Creating a new tax credit to rehabilitate affordable housing for homeowners who want to stay in their communities. This new Neighborhood Homes Tax Credit, would support the new construction or rehabilitation of over 400,000 owner-occupied homes in lower income communities.

- Building up supply through the first-ever tax incentive for building affordable homes for first-time homebuyers. Harris is proposing the first-ever tax cut specifically targeted at encouraging homebuilders to build affordable homes for first-time homebuyers. This would provide significant tax relief for homebuilders who build homes sold to working families and meaningfully change the economics of building homes that are within reach for younger families. This would complement the Neighborhood Homes Tax Credit, which encourages investment in homes that would otherwise be too costly or difficult to develop or rehabilitate.

- Launching a $40 Billion Local Innovation Fund for Housing Expansion. Harris’s plan would provide state and local governments, and private developers and homebuilders, funds to invest in innovative strategies to expand the housing supply. This could include financing the construction of new housing paired with efforts to reduce regulatory burden and cut red tape, employing innovative building and construction techniques to lower costs, and using self-sustaining financing mechanisms to scale new housing construction. This will be a results-driven innovation fund with one core requirement: state and local governments must show that they will deliver results in building rental properties and homes that are affordable.

- Taking on algorithmic price fixing, which distort markets, and ending unfair practices that help large corporate landlords dramatically raise rents. Harris is calling on Congress to pass the Preventing the Algorithmic Facilitation of Rental Housing Cartels Act, to crack down on companies that contribute to surging rent prices by making these unfair practices illegal under antitrust laws.

- Stopping Wall Street investors from buying up and marking up homes in bulk. Community after community feels taken advantage of by Wall Street investors and corporate landlords who have bought thousands of single-family homes during recent downturns. That’s why Harris is calling on Congress to pass the Stop Predatory Investing Act, to curtail these practices by removing key tax benefits for major investors that acquire large numbers of single-family rental homes. I personally hope that Congress passes this as soon as BLUE takes control.

None of the above Housing Plans will be done by Trump. He has a long and tawdry career in real estate. It began with discrimination against black tenants. Squeezing the last dollar out of his housing complexes was and is a main goal of Trump Inc. He wants you to believe the housing crisis is the result of immigration; that’s to prevent any government involvement in addressing systemic factors in the housing supply. As a builder, he wants to keep the government away from Trump Inc.

And the Republican Party has a visceral dislike of using government to regulate or restrain business – so they will most certainly oppose the last two proposals, if not ALL of them. They are the party that wants to allow business the freedom to make money by allowing monopolies and hedge funds to squash the poor, those that barely survive, the middle class, and weak businesses that contribute to a community. Don’t be fooled by their false claims of support for the working class and being anti-elite.

All of the Harris proposals are described in her detailed booklet, A New Way Forward for the Middle Class. Access the 80 page PDF booklet here.

A good summary from the Wall Street Journal on 9/12/2024:

Resources:

- Source of Some Numerical Facts

- 2016 personal income tax rates (Bradford Tax Institute): https://bradfordtaxinstitute.com/Free_Resources/2016-Federal-Tax-Brackets.aspx

- Current personal income tax rates (H&RBlock): https://www.hrblock.com/tax-center/irs/tax-brackets-and-rates/what-are-the-tax-brackets/

- Overview: https://www.millerkaplan.com/knowledge-center/taxes-take-center-stage-in-the-2024-presidential-campaign/

- About Child Tax Credits (Wikipedia): https://en.wikipedia.org/wiki/Child_tax_credit_(United_States)

- Harris and Trump both push for Child Tax Credit hike (CBSNews, 9/13/24): https://www.cbsnews.com/video/harris-and-trump-both-push-for-child-tax-credit-hike/#x

- Harris Campaign Site: https://kamalaharris.com/issues/

- Harris on Child Tax Credits (CBS News, 819/24): https://www.cbsnews.com/news/kamala-harris-child-tax-credit-6000-dnc-what-to-know/

- About the Earned Income Credit (Center on Budget and Policy Priorities [current 4/28/23]): https://www.cbpp.org/research/policy-basics-the-earned-income-tax-credit

- About the Earned Income Credit (Wikipedia [most information is ten years out of date]): https://en.wikipedia.org/wiki/Earned_income_tax_credit

- About the Earned Income Credit (Wikipedia [most information is ten years out of date]): https://en.wikipedia.org/wiki/Earned_income_tax_credit

- About housing shortage

- Harris proposals (Reuters, 8/26/24) ): https://www.reuters.com/world/us/harris-puts-housing-center-economic-pitch-us-voters-2024-08-26/

- Harris/Walz’s Plan to Lower Costs and Create and Opportunity Economy: https://kamalaharris.com/wp-content/uploads/2024/09/Policy_Book_Economic-Opportunity.pdf

- Summary Video (Wall Street Journal, 9/12/2024): https://youtu.be/pPlhS22BG9k?feature=shared

Pingback: 42) Harris is and will be a Calm and Steady hand at the wheel. Trump is Erratic and Impulsive, and his statements regarding the economy are just part of his pattern.