Let’s compare recent campaign pronouncements by Kamala Harris and Donald Trump about the corporate tax rate (the tax paid by incorporated businesses, large and small). Of course it is about raising needed revenue to run the government. But a candidate’s view about how to raise revenue indicates a preference of who should bear the burden of contributing the needed revenue. The poor? The workers? The middle class? The rich? The very wealthy? What percent of the tax burden should each share? What is fair?

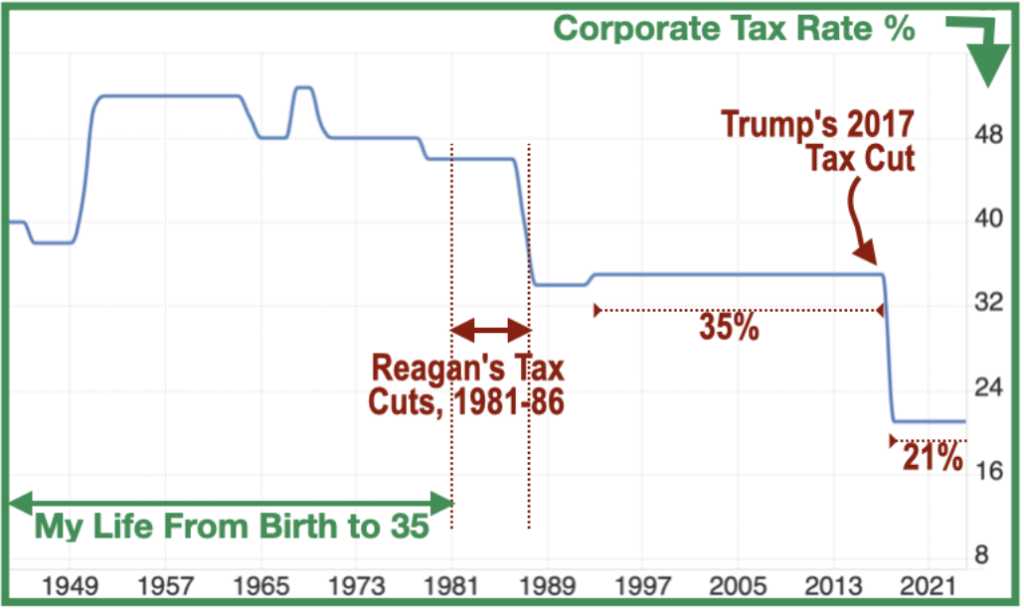

It is hard to understand any proposal to increase or decrease the corporate tax (or any tax) without an historical perspective. So, here you have the history of the corporate tax rate during my lifetime (I’m now 78).

My childhood in the 1950s and 1960s took place during generally great prosperity, even though the corporate tax rate was between 46% and 52%! Were there ups and downs? Yes. Was everyone prosperous? No! But -unlike today- there was a LARGE middle class. College didn’t cost a fortune and I graduated from a private college with only about $900 of debt, part of which the government forgave in exchange for my teaching which I wanted to do anyway.

One reason my childhood was a time of a healthy economy was because both parties reinvested the tax revenues –including the high revenues from the corporate tax– into America’s future: infra-structure [interstate highway system!], defense, NASA [it wasn’t privatized, and the government’s space program boosted research, and innovation], research in many areas, and education. The Department of Education was created then (part of the HEW Department) and it funneled tons of grant money into school systems including the public schools I attended.

Just saying, the wealthy class (via the GOP mostly) has always insisted that corporate taxes hurt everyone. It’s part of their trickle-down myth.

That’s why I question the idea that raising the corporate tax rate is bad for the economy. Here also is Robert Reich with 6 reasons why raising the corporate tax rate should be fine.

When Trump and the GOP lowered the corporate tax rate in 2017 from 35% to 21%, GOP leaders said then that it would lead to more business investment and higher wages for families.

Neither of those things happened. Instead, the tax savings that corporations received, especially the largest ones, went into stock buy-backs to increase the stock gain and into insanely higher “salaries” for corporate executives. In short, the corporate tax cut was a gift to the “elite” even though Trump continues to claim he opposes the elite.

And because “trickle-down” economics is a myth foisted on us by “the elite,” the tax cut led to record national debt… and record wealth inequality.

What is the Latest from the Candidates?

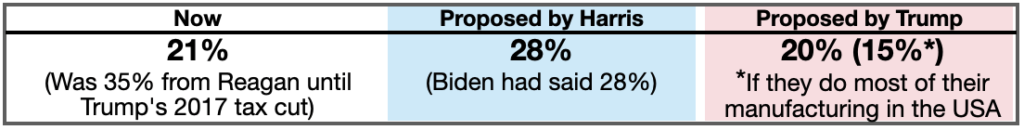

Personally, I’d like to see a 30-31% corporate rate, but at least Harris is proposing 28% — the right direction!

Trump has been campaigning on a 1% cut to 20% for months, including in a closed door meeting with the Business Roundtable on June 13, 2024.

On Thursday September 5, Trump came up with a new corporate tax proposal I find interesting while speaking at the Economic Club of New York. He wants to incentivize companies to do more of their manufacturing in America — which I agree with! — by lowering the corporate tax rate for companies that do this to 15%. Of course, there better be a rock-solid standard of criteria to apply becauise every corporation will find some excuse to claim the incentive reward!

But I do not agree with a 15% rate no matter what. Here’s possibly a better idea, if Kamala Harris is interested: Make the standard rate 30%; for those who can prove 80% (or whatever) of the products and their vendored sub-parts are made in America, let them have a 22% rate. Otherwise, I’m fine with a straight 28% rate for all corporate entities.

“Vote Blue All Down Through” for at least proposing a raise in the corporate tax rate.

Resources:

- “Trickle down economics (Wikipedia): https://en.wikipedia.org/wiki/Trickle-down_economics

- The rate chart: https://tradingeconomics.com/united-states/corporate-tax-rate

- What we learned from the Reagan tax cuts (Brookings, 12/8/17): https://www.brookings.edu/articles/what-we-learned-from-reagans-tax-cuts/

- Do corporations need a tax cut to be competitive? (Robert Reich, 9/29/17): https://www.youtube.com/watch?v=LyCjx2yCgi8

- Candidates (Tax Foundation): https://taxfoundation.org/research/federal-tax/2024-tax-plans/#Type

- Trump’s new 15% corporate tax rate incentive (CNBC, 9/6/24): https://www.youtube.com/watch?v=YYeFQda6uzM

- A full explanation of the failure of the 2017 tax cut: https://www.americanprogress.org/article/the-tax-cuts-and-jobs-act-failed-to-deliver-promised-benefits/